Why AI Is Breaking Your SaaS Pricing Model

AI-era cost structures demand a new pricing playbook. This article gives you one.

If you’re a SaaS founder/CEO, Chief Product Officer, or operator building or leading an AI-powered SaaS company, this article is for you.

Traditional SaaS had one big advantage: scale was nearly free. Once you built the product, adding customers cost next to nothing. So flat-rate or seat-based pricing worked. Margins were predictable. CAC payback was clean. You could scale confidently on simple assumptions.

But AI changes everything.

In an AI-native product, usage isn’t free, it costs real money. Every LLM query, vector search, or GPU call chips away at your margins. And the more your users engage, the more your cost to serve rises. That’s the opposite of classic SaaS economics. And yet most early-stage companies I talk to are still pricing like it’s 2018.

This article is for founders, Chief Product Officers, and GTM leaders at post-Seed to Series B AI startups. Especially those with some traction, some revenue, and growing pressure to scale efficiently. You’ve got CAC models in place. You’re talking about LTV. You’re trying to stretch your runway while showing momentum.

But here’s the reality: if you’re using legacy SaaS pricing with AI usage costs, you’re scaling margin risk, not revenue.

In this piece, I’ll walk you through:

Why traditional SaaS pricing models break down in AI products

How to rethink CAC payback using contribution margin, not just revenue

A step-by-step framework to design margin-aware, usage-aligned pricing models that actually scale

If you want to grow efficiently in the AI era, you need to stop measuring what’s easy, and start measuring what’s true. Let’s fix the pricing model before it breaks your business.

CAC Payback, and what everyone is getting wrong

Again and again I’m seeing two fundamental mistakes being made when it comes to pricing and packaging. And it all hinges on CAC Payback.

CAC payback is one of the most important metrics for a SaaS startup because it tells you how long it takes to recover the cost of acquiring a customer. It’s a direct measure of growth efficiency and cash flow health. A short payback period means you can reinvest quickly and scale sustainably; a long one means you're likely burning capital to grow. For founders, it shapes decisions around pricing, margins, GTM strategy, and fundraising. And for investors, it’s a clear signal of whether your business can scale profitably, or if you're just buying growth.

In almost every AI startup I speak with, I’m seeing founders trying to use legacy seat-based SaaS pricing models and revenue-based CAC payback assumptions in a world where the former no longer applies, and the latter was always wrong.

That disconnect is creating a false sense of efficiency, and it's causing teams to spend, sell, and scale before they understand whether any of it is profitable.

CAC Payback Fundamentals

Some new founders are building CAC payback calculations based on revenue instead of contribution margin. And they’re shocked when growth doesn’t improve runway.

Let’s model this out to make it clear. You have a fairly outbound-heavy sales process and ad-based demand generation motion driving CAC to be $3,600. You’re charging each customer $300 per month (MRR) and so you incorrectly calculate that you have a CAC Payback period of 12 months.

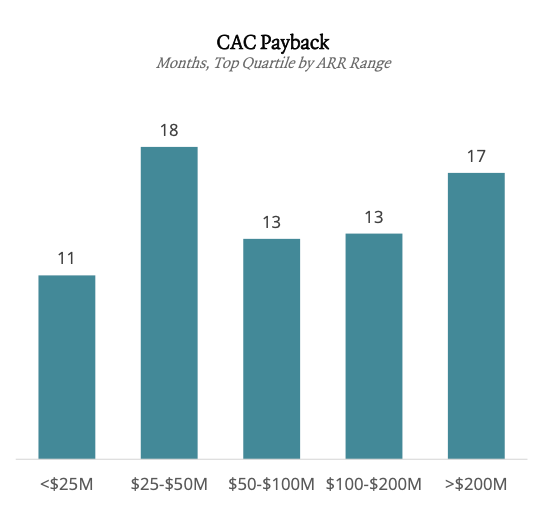

Referencing the ICONIQ Scaling SaaS: Forging Excellence Through Fundamentals report (see chart above), this sounds great! You’re doing $25M ARR, and according to ICONIQ, you’re performing better than the top quartile of all of the startups in their report. Awesome! Wrong!!

In reality, we pay down our CAC using contribution margin dollars. This means that we subtract from gross revenues onboarding and implementation services, customer support, success and account management time, usage-based third-party tools (like Stripe or Segment), and training or enablement resources.

We add all of this up and it results in a gross margin of ~67% (keeping the math simple). This gives us a contribution margin of $200/month (67% * $300). Therefore, our CAC Payback is actually 18 months rather than the incorrectly thought 12 months.

We’re right on the money for top-quartile performers! Awesome!

But what if you’re an AI company?

🤖 AI Has Changed the SaaS Margin Model

Classic SaaS had one huge financial advantage: once you have built the product, delivering it was almost free. Gross margins were 80–90%. The incremental cost to serve an additional customer was negligible. But that’s no longer true in an AI-first world.

In the age of AI, the cost structure of SaaS businesses is rapidly changing, but not always in predictable ways. While AI promises to reduce headcount, automate support, and streamline onboarding, it often introduces new variable costs. From OpenAI or Anthropic tokens, to GPU inference costs, to human-in-the-loop QA. Many of these expenses scale with usage. That means your margin per customer isn't fixed. It shrinks as adoption and engagement grows.

I’ve spoken to a number of AI startup founders recently, and here’s the pattern I’m seeing: They’ve built promising products, landed early customers, and are now trying to scale. But they’re struggling with pricing and packaging, not because their price points are too low or high, but because they’re modeling their business like a traditional SaaS company.

That’s why contribution margin is more important than ever. As AI becomes embedded in your product, gross margin can silently erode, making acquisition look profitable on paper while masking deep inefficiencies underneath. CPOs, CFOs, and GTM leaders need to partner closely to model CAC payback using contribution margin, not just revenue or legacy gross margin assumptions. In AI-powered SaaS, growth only works if it's margin-aware.

⚠️ What’s Actually Going Wrong?

To illustrate just how critical it is to account for variable costs in AI-based SaaS, let’s look at two customers who appear identical on paper: same CAC, same monthly subscription, same plan. But their behavior tells a very different story.

One is a highly engaged user leveraging AI features heavily; the other is lightly engaged. At first glance, and using classical product engagement metrics, the engaged user might seem like your ideal customer. But once you factor in the cost to serve, you’ll see why usage-based variable costs can completely distort your unit economics and CAC payback assumptions.

📈 Customer A: Highly Engaged (Heavy AI Usage)

Customer A is a power user - the type of user we love! They log in daily, rely heavily on AI features, and generate about 150 AI requests per day, totaling roughly 4,500 requests per month. Each AI call costs the company $0.04 in API and infrastructure costs, adding up to $180 in variable expenses. Factor in another $40 in support and platform-related costs, and the total cost to serve this user reaches $220 per month. That leaves just $80 in contribution margin. When you divide the $3,600 CAC by $80, the payback period balloons to 45 months. Despite being a highly engaged customer, Customer A is barely covering their cost of acquisition, and is eroding the company's margins every month they stay on the platform.

📉 Customer B: Lightly Engaged (Low AI Usage)

Customer B, is lightly engaged. They use the product occasionally, and normally someone we’d be worried about churning. They maybe make 10 AI requests a day, adding up to around 300 requests a month. That equates to just $12 in AI-related costs, plus another $18 in platform overhead and minimal support. Total cost to serve: $30. That leaves a healthy $270 in contribution margin each month. The CAC payback period in this case is just 13.3 months, over three times faster than Customer A’s.

The lesson? In AI SaaS, usage isn’t just a signal of value, it’s also a cost driver. If you're only measuring revenue or engagement, you might mistake your most expensive customers for your best ones. Without understanding contribution margin, you're likely to scale a product that loses more with every "successful" user.

🚨 Why This Matters

Flat-rate, unlimited AI usage may feel user-friendly early on, but it’s a time bomb for unit economics. As usage scales, your margins collapse, and your CAC payback stretches endlessly.

This is why Founders, CEOs, and product leaders need unit economics fluency. You must partner with our CFO and dig deep into what is driving our business. You must model and build into our product strategy and roadmap how what you build and release influences the financials.

This means what we build. How a user interacts with the product. The value they extract from the product. And the costs each interaction incurs.

💡 Exploring the AI Pricing Stack

As AI-powered SaaS products mature, so must their pricing strategies. The traditional seat-based, flat-rate models borrowed from classic SaaS no longer reflect the economics of usage-based infrastructure, variable cost delivery, or intelligent automation. Instead, pricing needs to evolve alongside the product—starting simple, then gradually aligning more closely with how value is delivered, how costs are incurred, and how customers perceive fairness.

In this section, I’ll walk through six pricing approaches that map to different stages of product and company maturity. From predictable base subscriptions to usage metering, credit bundles, workflow and outcome-based pricing, all the way to agent-level monetization. These aren’t just pricing mechanics, they’re strategic choices that impact margin, positioning, and buyer psychology. Let’s start with the simplest: flat fees.

1. Base Subscription (Flat Fee)

Charge a predictable monthly fee that includes access to core features, light AI usage, and platform access. For example, $150/month for access + up to 1,000 AI requests. This will cover the product, onboarding, non-AI workflows, and some margin-friendly usage. It ensures consistent recurring revenue and supports budgeting for customers.

Flat-rate pricing is often the first instinct for SaaS founders, and for good reason. It’s easy to understand, simple to communicate, and offers predictability to both the company and the customer. For early-stage AI products, a base subscription that includes access to the platform and a reasonable amount of AI usage (e.g., 1,000 API calls/month) can reduce friction in the buying process while covering most margin-friendly users.